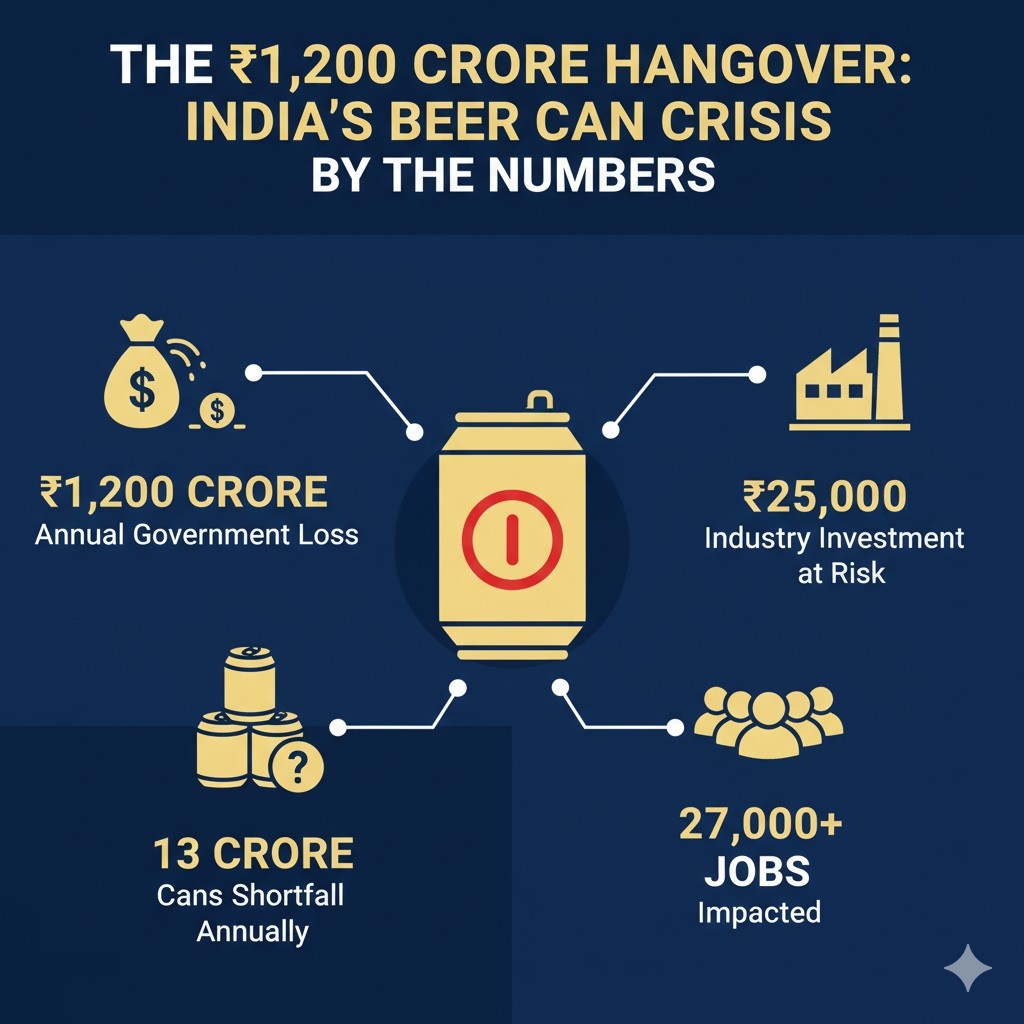

A quiet crisis is bubbling over in India beer industry, and it has nothing to do with hops or barley. It’s a crisis of packaging, a crippling shortage of the simple aluminum can that is set to trigger a massive financial hangover, costing the government an estimated ₹1,200 to ₹1,300 crore in lost revenue. A well-intentioned quality control regulation has inadvertently created a supply chain catastrophe of almunium beer can shortage, threatening to put a cap on the nation’s booming beer industry and sending shockwaves through its economy.

Just How Big is India’s Thirst for Beer?

To understand the scale of the crisis, one must first appreciate the titan of industry it affects. India’s beer market is a powerhouse, boasting over 55 breweries and fueled by a colossal ₹25,000 crore in investment. It’s a vital engine of employment for over 27,000 people. Valued at a staggering USD 7.8 billion in 2024, the market is poised for explosive growth, with a projected annual growth rate of 11.7% through 2030. Within this landscape, the sleek, portable aluminium can has become a consumer champion, accounting for nearly 20% of all beer sales. Its steady supply is no longer a luxury; it’s the lifeblood of the industry’s future.

Why Did the Government Impose These Quality Controls on Beer Can?

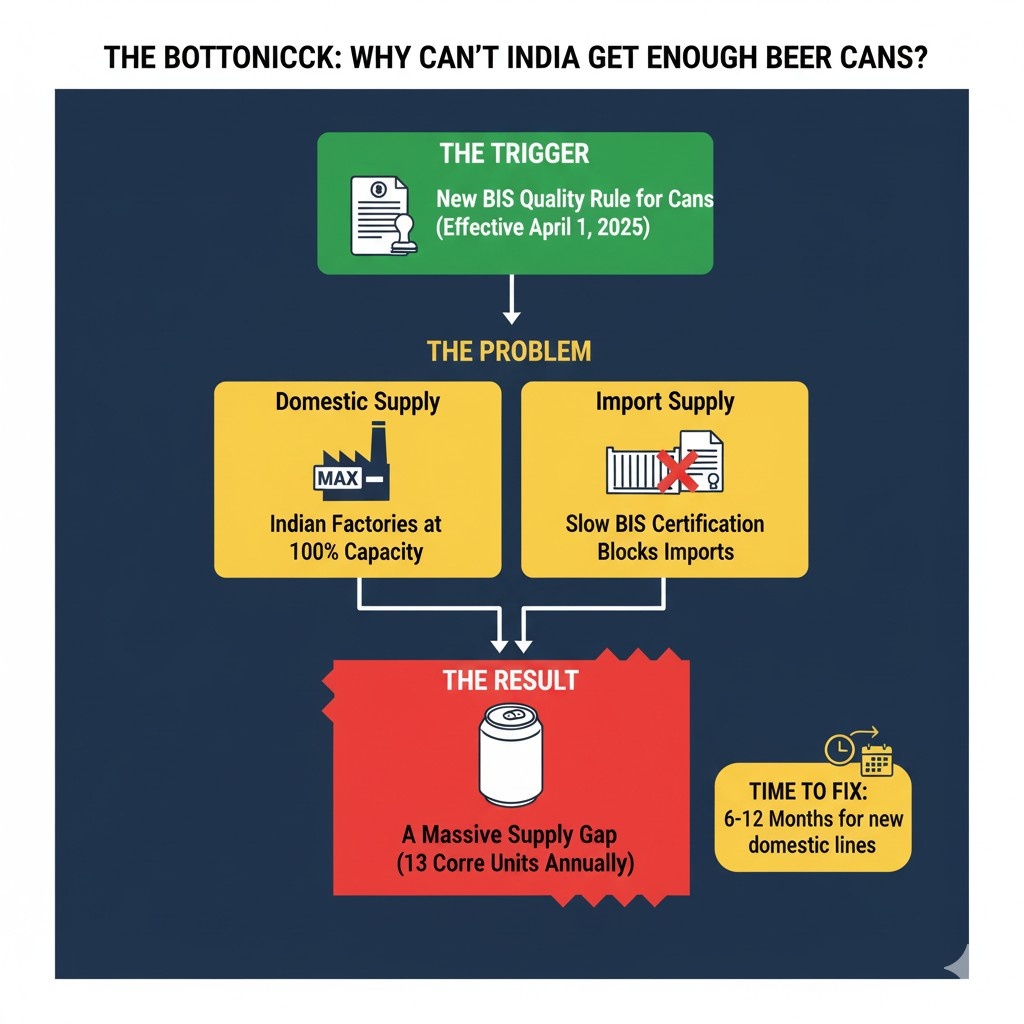

The chaos of beer can shortage can be traced back to a Quality Control Order (QCO) effective April 1, 2025, which placed aluminium cans under mandatory Bureau of Indian Standards (BIS) certification. While this move has choked the industry, it wasn’t without reason. The government’s policy appears to be driven by three key objectives:

- Promoting ‘Make in India’: The QCO aligns with the broader national strategy of Atmanirbhar Bharat (self-reliant India), aimed at boosting domestic manufacturing and reducing dependency on foreign imports.

- Ensuring Consumer Safety: By enforcing BIS standards, the government aims to protect consumers from potentially substandard imported materials, ensuring the integrity of everything from the grade of aluminium to the can’s internal lining.

- Preventing Market Dumping: Such regulations act as a quality floor, preventing the market from being flooded with cheap, low-grade imports that could undercut domestic producers and compromise safety.

However, the policy’s rigid and slow implementation for foreign suppliers has led to these severe, unintended consequences.

Why Can’t India Just Make More Cans and Overcome Aluminium Beer Can Shortage?

The immediate, brutal answer is: it can’t. Not overnight. India’s main domestic can manufacturers, BALL Beverage Packaging India and Can-Pack India, are already operating at maximum capacity. Expanding their output requires building entirely new production lines—a complex and costly undertaking that takes a minimum of six to twelve months. This domestic production ceiling is further compounded by India’s limited ability to produce the specific grades of raw aluminium needed for cans, making a reliance on imports an unavoidable reality.

How Deep Does the Shortage Run?

The numbers are staggering. The industry is staring at an annual deficit of 12 to 13 crore 500ml aluminium cans. This isn’t a minor gap; it’s a chasm representing nearly 20% of all beer sold in cans nationwide. The scale of this shortfall is stark, best visualized by a bar chart where the towering bar of “Annual Demand” dwarfs the “Domestic Production Capacity,” leaving a massive, unfulfilled gap. This deficit is a critical bottleneck, throttling the market’s growth potential.

Who is Really Paying the Price for Beer Can Shortage?

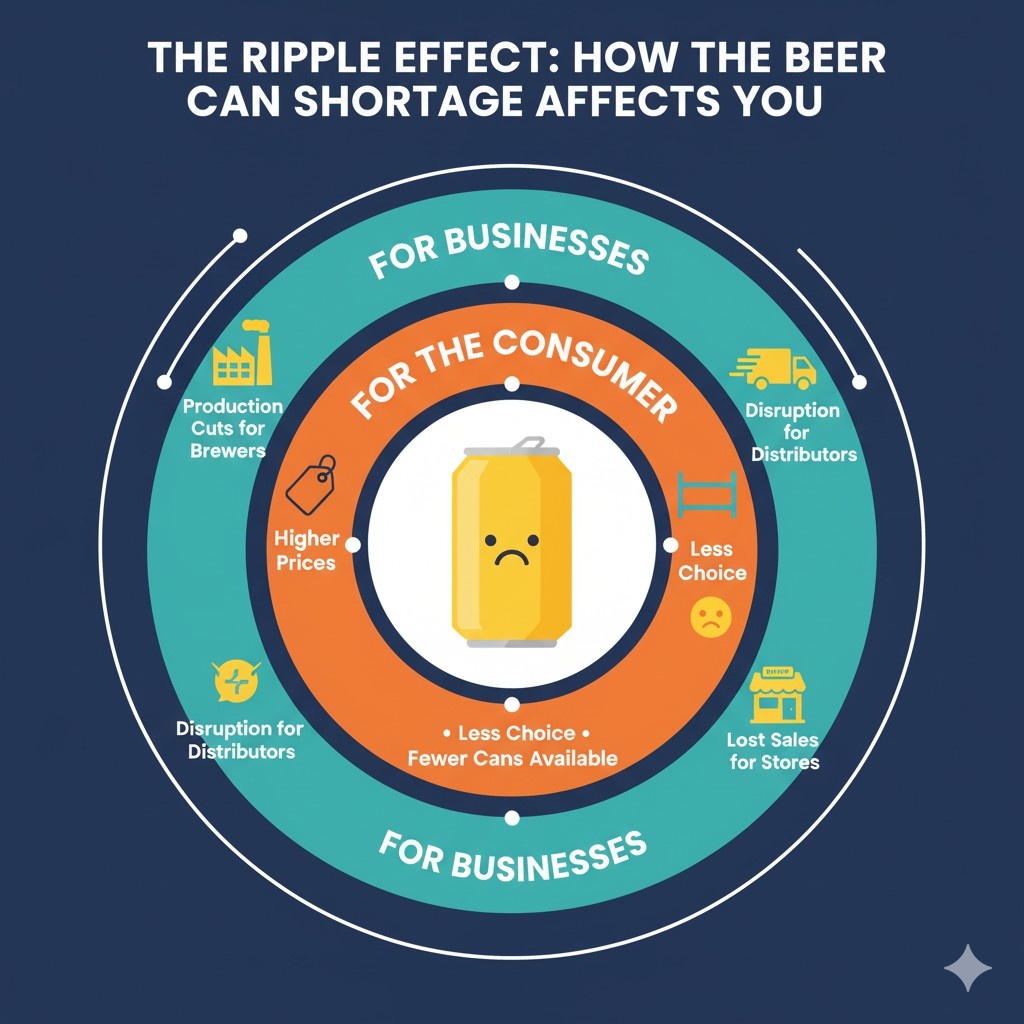

While corporations and governments feel the financial heat, the pain on the ground is palpable and personal.

- The Craft Brewer: “For the big players, beer can shortage is a major supply chain issue. For my small brewery, it’s an existential threat,” says the owner of a microbrewery in Bengaluru. “We don’t have the volume or leverage to secure the few cans that are available. Cans are our primary way to get our product into homes, and without them, we’re invisible.”

- The Distributor: A logistics manager in Mumbai describes the chaos: “Our schedules are a mess. Breweries are cutting our allocations last minute. Our trucks are leaving warehouses half-empty. Retailers are furious, but our hands are tied. The entire distribution network is running on uncertainty.”

- The Retailer: At a liquor store in Delhi, the owner gestures to an empty shelf space. “A customer comes in for a six-pack of their favorite canned beer for the cricket match. I tell them we’re out. They don’t just switch to a bottle; they often just leave. That’s a direct sale lost, and it happens dozens of times a day.”

Will My Favorite Beer Disappear or Get More Expensive?

For the average consumer, this ‘beer can shortage’ crisis will soon hit home in three distinct ways:

- Price Hikes: With cans becoming a scarce commodity, their cost is rising. Brewers will inevitably be forced to pass these increased costs on to consumers, meaning the price of a canned six-pack is likely to climb.

- Reduced Availability: Consumers will find their favorite brands, especially those predominantly sold in cans, are frequently out of stock. Limited edition and seasonal craft beers, which often rely on cans for their launch, may not be released at all.

- Forced Change in Habit: Brands may be forced to shift more production to glass bottles. This could inconvenience consumers who prefer the portability, faster chilling, and safety of cans for outdoor events, picnics, and travel.

If Cans Are the Problem, Why Not Switch to Glass Bottles?

This is the most common question, but the solution isn’t that simple. Breweries cannot just flip a switch.

- Different Machinery: Canning and bottling lines are entirely separate, multi-crore industrial systems. A brewery geared for cans cannot simply start filling bottles without massive new capital investment and months of installation and recalibration.

- Logistical and Cost Nightmare: Cans are the preferred packaging for a reason. They are significantly lighter than glass, which dramatically reduces transportation costs and the carbon footprint. They are also unbreakable and stack more efficiently, optimizing warehousing and shipping.

- Product Quality: Cans offer superior protection from light and oxygen, two of beer’s biggest enemies. This preserves the flavor and extends the shelf life of the product in a way that many bottles cannot.

How Far Do the Economic Shockwaves Travel?

The ₹1,200 crore revenue loss is just the epicenter of a much larger economic earthquake. The shockwaves of beer can shortage travel far and wide, impacting a whole ecosystem of ancillary industries: the printers who design and produce the vibrant can labels, the manufacturers of the plastic rings and cardboard cartons used for packaging, and the transporters whose fleets now move less product. Furthermore, this level of regulatory volatility can have a chilling effect on future investment, making both foreign and domestic investors wary of pouring capital into a sector where the supply chain can be disrupted overnight by a policy change.

What Are the Brewers Pleading For?

Facing this existential threat, the Brewers’ Association of India (BAI) has made an urgent appeal to the government. Their request is not to scrap the quality standards but to implement them pragmatically. They are asking for a deferral of the BIS certification for imported cans until April 1, 2026. This would provide a critical window for domestic manufacturers to scale up their capacity while allowing the industry to breathe. They also seek an interim allowance for imports from suppliers whose BIS applications are already in the pipeline, a move that could immediately ease the bottleneck.

Is There a Long-Term Fix on the Horizon to Overcome Been Can SHortage?

A sustainable solution to overcome beer can shortage demands a collaborative approach. While domestic manufacturers must accelerate their expansion plans, the government needs to streamline the BIS certification process for foreign suppliers to create a resilient and flexible supply chain. Without timely intervention, this simple can shortage will continue to hamper a thriving industry, drain government revenues, and ultimately leave the Indian consumer with less choice and higher prices. The path forward requires a balanced policy that champions domestic manufacturing without crippling the very industries it aims to support.